More Details

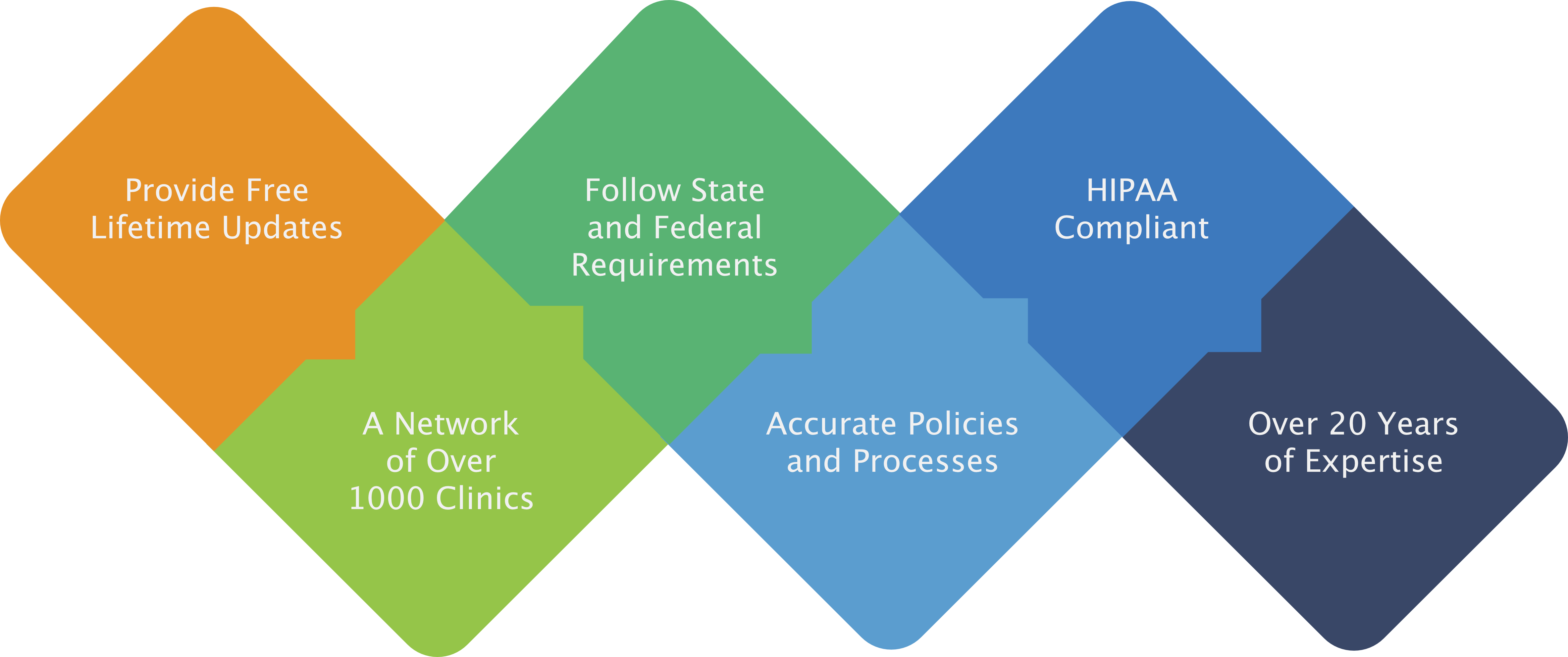

| 📺 Watch 📺 our overview of the Company Policy Manual here! The success of your ABA company’s mission hinges on your ability to clearly communicate policies and standards to your staff. In addition, you must document these policies to avoid potential misunderstandings. Our experts at 3 Pie Squared have helped over 900 ABA businesses improve their operations management processes. We have developed a Company Policy Manual to help ABA companies properly oversee their staff. This manual is a key component in our comprehensive suite designed to pass audits, including Optum, Kaiser, BHCOE, and Medicaid. This 260-page Company Policy Manual provides a clear framework for all applicable policies. Moreover, to ensure proper implementation, the policy framework is complemented with quizzes and checklists designed to educate employees and address all components of these policies. By utilizing our Company Policy Manual, you can establish a solid foundation for managing your staff and ensuring compliance with state requirements. Check out what you get by scrolling down |

|

|

Quality Policy |

|

References |

|

Terms and Definitions |

|

Control of Documents |

|

Control of Records |

|

Management Commitment |

|

Client Focus |

|

Quality Policy |

|

Planning |

|

Quality Objectives |

|

Continuity of Operations |

|

Responsibility, Authority and Communication |

|

Responsibility and Authority |

|

Management Representative |

|

Communication |

|

Management Review |

|

Review Input |

|

Review Output |

|

Resource Management |

|

Provision of Resources |

|

Competence, Awareness and Training |

|

Hiring Process |

|

Materials and Resources |

|

Working Environment |

|

Crisis Management |

|

Whistleblower Policy for Employees and Managers |

|

CPR Training |

|

Day Program |

|

OSHA |

|

Worker’s Compensation Procedures for Managers |

|

Inclement Weather |

|

Training |

|

Workers’ Compensation |

|

Employee Acknowledgement Form |

|

Travel Time |

|

Expense Reimbursement |

|

Supervision Assistance Program and Tuition Assistance Program |

|

Meal Waiver |

|

Antidiscrimination/ Antiharassment Policy |

|

Equal employment opportunity |

|

Retaliation |

|

Sexual harassment |

|

Harassment |

|

Individuals and Conduct Covered |

|

Reporting an Incident of Harassment, Discrimination or Retaliation |

|

Complaint Procedure |

|

Tuition Reimbursement/Education Assistance Reimbursement Agreement |

|

Prospective/Referred Clients |

|

Contacting the Client |

|

Scheduling Intake |

|

Intake Process |

|

Collection of Documentation |

|

Assessment Process |

|

Referral & Termination Process |

|

Parent Participation |

|

Client & Employee Safety |

|

Termination of Services |

|

Client Surveys |

|

Client Complaints |

|

Background Check Procedure |

|

Fingerprinting Employees |

|

Client Complaints Procedure |

|

Client Complaint Form |

|

Client Satisfaction Survey Procedure |

|

Continuous Improvement Project Procedure |

|

Control of Records Procedure |

|

Document Control Procedure |

|

Emergency Procedure |

|

Incident Report |

|

External Referral Procedure |

|

Hand Washing Procedure |

|

Infectious Disease Procedure |

|

Oral Hygiene |

|

Cleaning and Sanitizing |

|

Sanitizer Chart |

|

Food Contact Surfaces |

|

Food Safety |

|

Prevention of Food-borne Illness |

|

Other Precautions |

|

Personal Belongings |

|

Insect Precautions |

|

Disease Control |

|

Internal Referral Procedure |

|

Parent Participation Procedure |

|

Supervision Procedure |

|

Disciplinary Procedure |

|

Sexual Harassment Procedure |

|

Responding to Conduct in Violation of Policy |

|

Complaint Resolution Procedures |

|

Discipline |

|

Confidentiality |

|

Ergonomics and Toxic Exposure Procedure |

|

Musculoskeletal Injuries |

|

Preventive Measures |

|

Environmental Hazards: Exposure to Toxic Materials |

|

Fire Safety and Disaster Emergency Evacuation Procedure |

|

Emergency Response Plan |

|

Session Guidelines and Data Collection Work Instruction |

|

Evaluation Work Instruction |

|

Client Binder Work Instruction |